Frequently Asked Questions

What is the ERS?

The ERS is the Commission’s primary retirement plan for its employees. The ERS was established July 1, 1972, and has been periodically amended over time. It is a defined benefit plan, qualified in accordance with the IRS Code, Section 401(a). Today, the ERS consists of five defined benefit pension plans: Plan A, the original plan; Plan B, for non-police; Plans C and D, for park police; and, Plan E, for non-police and appointed officials hired on or after January 1, 2013.

Who oversees the ERS?

The ERS is administered by the Board of Trustees in accordance with the Trust Agreement between the Commission and the Board. The Board sets policies and guidelines for administration of the ERS and employs an Executive Director to manage and oversee the day-to-day operations. The Board is composed of appointed and elected officials.

What is a defined benefit plan?

A defined benefit plan is a pension plan established and maintained by an employer to provide for the payment of a determinable benefit over a period of years, usually for life after retirement. A defined benefit payment is based on your salary and years of credited service and does not depend on your contributions paid to the ERS, nor the amount of investment income the ERS has earned. Eligibility requirements and the underlying provisions of the pension plans are detailed in the Plan Documents.

Are my pension contributions taxed?

You do not have to pay income taxes on your contributions to the ERS. Federal and State income taxes are deferred until you receive a benefit from the ERS.

How are contributions to the ERS invested and are the assets protected?

The Board of Trustees selects professional investment managers who invest the assets of the ERS. The Board of Trustees sets the investment policy and guidelines as well as oversees the investment managers to ensure the investment objectives are met. The ERS’ custodian bank holds plan assets for safekeeping and serves as the official book and record for investment transactions and valuations. Staff account for all the assets and payments of the ERS. An independent accounting firm audits the ERS every year. The ERS has received the highest possible evaluation for its accounting and internal controls.

Are employee contributions required?

Yes. Employees enrolled in the ERS are required to contribute a percentage of their base pay each pay period. The contributions vary by plan. For more information, please refer to your respective Plan Document or Summary Plan Description.

Does the Commission make contributions?

As the employer, the Commission makes contributions to the ERS that are actuarially determined to be required to provide for future retirement benefits under the plans of the ERS. Contributions made by the Commission are to be used solely for the benefit of plan members and beneficiaries.

Are loans allowed from the pension plan?

No, loans or partial withdrawals are not allowed under any circumstances. You can only withdraw pension contributions upon separation from Commission employment.

How does accumulated sick leave affect my benefit?

You can receive additional credited service for your earned, but unused sick leave. For every 176 hours of sick leave you have at retirement, you receive one month of additional credited service. The remainder of at least 120 hours or more qualifies you for an additional month. You may use a maximum of 14 months to qualify for early or normal retirement. However, this credit cannot be used to meet the minimum retirement eligibility requirements for age. There may be some exceptions that apply to certain park police officers.

For Example:

Hours Based on 8.0 Hour Day | |

| 1 Year | 2,112 |

| 11 Months | 1,936 |

| 10 Months | 1,760 |

| 09 Months | 1,584 |

| 08 Months | 1,408 |

| 07 Months | 1,232 |

| 06 Months | 1,056 |

| 05 Months | 880 |

| 04 Months | 704 |

| 03 Months | 528 |

| 02 Months | 352 |

| 01 Month | 176 |

When is the best time to retire?

There is not necessarily a “best” time to retire; however, you may want to consider several things when making your decision to retire:

- Cost-of-Living Adjustments (COLAs)

COLAs are issued July 1st to retirees and beneficiaries who have been receiving a payment for at least six months. Therefore, if you retire by January 1st of any given year you are entitled to a COLA on July 1st of that same year. If you retire after January 1st, you are not eligible until July 1st of the following year.

- Payout for Annual Leave, Holiday, and Comp Time:

If you are considering retiring at the end of the year, you should remember that you may receive annual leave, holiday pay and comp time in the pay period following your last pay period.

How do I apply for retirement benefits?

Approximately two months prior to retirement, you need to contact the ERS to make an appointment for your final retirement counseling session. Please check with your department for other specific requirements.

What if I don’t leave a surviving spouse or children?

If a participant or vested member dies and does not leave a surviving spouse or children eligible for the survivorship benefit, the designated beneficiary shall be entitled to a lump sum cash payment in an amount equal to the sum of the following: (a) 50% of his/her average annual earnings; plus (b) his/her total contributions to the ERS, with interest thereon at a rate of 4.5% per annum.

Can I have my benefit check directly deposited into my bank account?

Yes. In fact, the ERS strongly encourages all retirees and beneficiaries to sign up for direct deposit.

When can I expect to receive my first retirement benefit check?

You can expect to receive your first two or three retirement payments eight (8) to ten (10) weeks after the effective date of your retirement date provided adequate notice was provided of your intention to retire and all required paperwork was received in good order. There are many factors affecting the processing and set up of retirement benefit payments, including payroll delays, activation timing, number of retirements, retroactive salary adjustments, long-term disability, leave without pay, domestic relations orders, part-time service, and actuarial deficiency calculations.

Is there a Cost-of-Living Adjustment to protect against inflation?

Retirees and survivors who have been receiving an annuity for at least six months may have a Cost-of-Living Adjustment (COLA) applied to their retirement benefit each year as of July 1st. It is based on the percentage change in the preceding 12 months for the Consumer Price Index (CPI)– All Items Annual Average, Urban Index for Major U.S. Cities. The maximum COLA varies by period of credited service. Please review the Plan Document or Summary of Plans for more information concerning COLAs.

Is life insurance available when I retire?

No. However, upon the death of a retired member, a $10,000 lump sum death benefit is paid to the designated beneficiary. This payment is taxable.

What are my options if my employment with the Commission terminates?

A Member, whose employment with the Commission terminates, other than by death, or retirement on an Early Retirement Date or Normal Retirement Date, shall be entitled to one of the following options:

- Refund of Contributions – You may elect to receive a lump sum payment of contributions made to the ERS, with an interest rate of 4.5% per year. This election eliminates entitlement to any other benefits under the plan.

- Rollover Contributions – You may elect to roll over contributions to another qualified plan or individual retirement account, without penalty or immediate income taxability.

- Vested Benefits – Based upon your years of credited service you may be entitled to receive an annual benefit. Please refer to the Plan Document to review the vested benefits eligibility requirements.

- Keep Contributions in ERS – If you choose to keep contributions in the ERS and later return to employment with the Commission, you will be credited with the initial period of credited service.

- Transfer – You may be able to transfer credited service to other eligible governmental retirement systems in the State of Maryland. This may require the concurrent transfer of accumulated contributions to the new system. Eligibility is based upon the plan provisions of the new retirement system. Please submit all inquiries to the new retirement system.

Is there a Disability Retirement benefit?

Effective August 1, 1982, disability retirement benefits were discontinued under the ERS in favor of a comprehensive Commission sponsored Long-Term Disability Insurance Plan. Members receive free credited service until their normal retirement date so long as they qualify for the disability insurance benefits.

My Benefit Estimate Summary Letter mentions a step-down date. What does this mean?

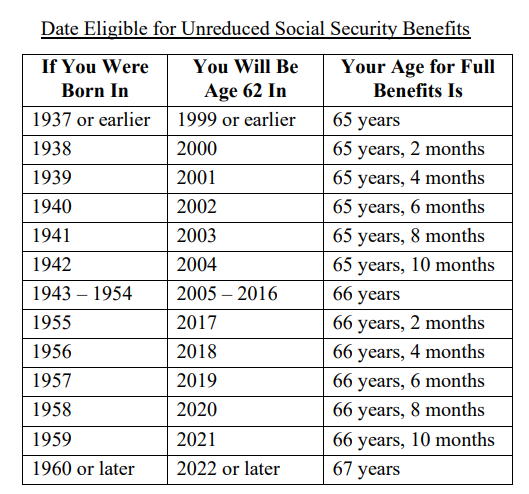

Date Eligible for Unreduced Social Security Benefits

The chart that follows determines the date members are eligible for full Social Security benefits. It also determines the date that members of Plan B or E have their benefits stepped down or reduced. Members can take Social Security early at age 62 with a reduction; however, the ERS does not step down ERS benefits until members are eligible for full Social Security benefits.

For example, members born in 1955 are eligible for full Social Security benefits at age 66 years 2 months. These members can elect to receive Social Security early at age 62; receive full benefits at age 66 years 2 months; receive benefits any time between age 62 and age 66 years 2 months; or receive benefits after eligibility for full benefits. The ERS steps down/reduces benefits at age 66 years 2 months which is the date eligible for full Social Security benefits.

What retirement options do I have?

Click to view Retirement Options

How does the Contingent (Survivor) benefit work?

Contingent Annuity Option

If a member elects a contingent annuity option, the benefit is reduced to reflect that payments are guaranteed for two lifetimes. The amount of the reduction is based on the member’s age and the age of the member’s contingent beneficiary at retirement.

100% J&S 75% and 50% Contingent Annuity Options

Benefits are guaranteed to the retiree for his/her lifetime. A percentage of the monthly benefit (100%, 75% or 50% depending on the chosen option) will be paid to the surviving contingent beneficiary after the death of the retiree. The contingent beneficiary cannot be changed after retirement.

100% J&S 75% and 50% Contingent Annuity with Pop-Up Options

Benefits are guaranteed for the retiree’s lifetime. A percentage of the monthly benefit (100%, 75% or 50% depending on the chosen option) is paid to the surviving contingent beneficiary after the death of the retiree. However, if the contingent beneficiary dies before the retiree, the retiree’s benefit reverts (pops-up) to the unreduced amount originally calculated, adjusted for cost-of-living adjustments granted since benefits began. The contingent beneficiary cannot be changed after retirement.

What is the difference between Normal (Service) and Early Retirement?

Normal (Service) Retirement – Members may retire with full allowable benefits after attaining the age and credited service outlined in the applicable Plan guidelines.

Early Retirement – Members may retire with reduced benefits after attaining the age and credited service outlined in the applicable Plan guidelines.